3 Ways to Identify a Ponzi Scheme and Tips to Protect Yourself

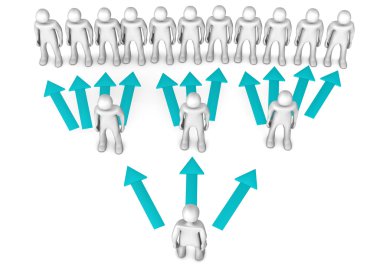

A Ponzi scheme is one of the most infamous types of financial fraud, luring unsuspecting investors with promises of high returns and low risk. Named after Charles Ponzi, who orchestrated a massive investment scam in the 1920s, these schemes rely on using new investors’ funds to pay earlier investors, creating an illusion of profitability.

Eventually, they collapse when the operator can no longer recruit enough new investors to sustain the payouts. Here’s how to identify a Ponzi scheme and avoid falling victim.

1. Promises of High Returns with Little to No Risk

One of the most obvious red flags of a Ponzi scheme is the promise of unusually high returns with minimal or no risk. Legitimate investments carry some level of risk, and no credible financial adviser or investment opportunity can guarantee consistent high returns.

For instance, if an investment opportunity claims you’ll earn 20% profit every month regardless of market conditions, it’s likely too good to be true. Be wary of phrases like “guaranteed returns” or “risk-free investments” — these are tactics often used to entice victims.

2. Overly Consistent Returns

Investments typically fluctuate based on market performance. Stocks, bonds, and other assets experience ups and downs depending on economic factors. However, Ponzi schemes often present an unrealistic picture by showing steady, predictable gains over time.

If an investment claims to provide consistent returns regardless of market volatility, this could be a sign of fraudulent activity.

Scammers use these claims to create a false sense of security and lure more victims.

3. Lack of Transparency

Legitimate investment opportunities come with clear, detailed explanations of where your money is going and how it will generate returns.

Ponzi schemes, on the other hand, operate in secrecy. You may encounter vague or overly complex explanations that lack substance, making it difficult to understand the business model.

Be cautious if the operator refuses to provide clear documentation, audited financial statements, or proof of legitimate business activities. A common tactic is to distract investors with glossy brochures or high-pressure sales pitches instead of real, verifiable details.

Tips to Avoid Falling Victim to a Ponzi Scheme

1. Research the Investment and the Operator

Before investing, research the company, its leadership, and the offered product or service. Check for licenses and regulatory compliance with organizations like the Securities and Exchange Commission (SEC). A lack of registration or previous allegations of fraud should be a major red flag.

2. Verify with Independent Sources

Do not rely solely on the information provided by the promoter. Seek independent reviews and consult with trusted financial advisers. Ponzi schemes often use testimonials from “happy investors,” which may be fabricated or from early participants unaware of the scam.

3. Be Skeptical of Time-Sensitive Offers

Fraudsters often pressure potential victims with limited-time offers to prevent them from conducting due diligence. Take your time to investigate before making any financial commitments.

Conclusion

Ponzi schemes prey on greed, trust, and a lack of financial knowledge.

By staying informed and vigilant, you can protect your hard-earned money from fraudsters. Always remember: if an investment seems too good to be true, it probably is. Prioritize due diligence and consult with professionals to ensure your financial safety.